– Why Every Couple Should Consider Wedding Insurance👰🤵💍

Planning your wedding is one of the most exciting times of your life—but it’s also a big investment, and unexpected surprises can happen. Whether it’s a no-show vendor, a sudden illness, or an over-celebratory guest at the open bar, having event insurance—including liquor liability—can protect your big day from becoming a big headache.

Here’s what you need to know—and why every smart couple should consider it.

1. What Is Wedding & Event Insurance?

Wedding insurance comes in several forms, each designed to protect your time, money, and peace of mind.

- Cancellation/Postponement Insurance

Covers your non-refundable deposits and costs if your event must be canceled or delayed due to illness, weather, military duty, or vendor failure.

- General Liability Insurance

Covers property damage or injuries that happen during your wedding. This is often required by venues—including barn venues like Irish Hills Wedding Barn.

- Liquor Liability Insurance

Covers alcohol-related incidents, such as if a guest becomes intoxicated and causes property damage or injury. This is crucial if you’re serving alcohol at your event—especially with an open bar or if you’re supplying your own.

✅ Many venues and bartending companies require proof of

liquor liability coverage as part of their contracts.

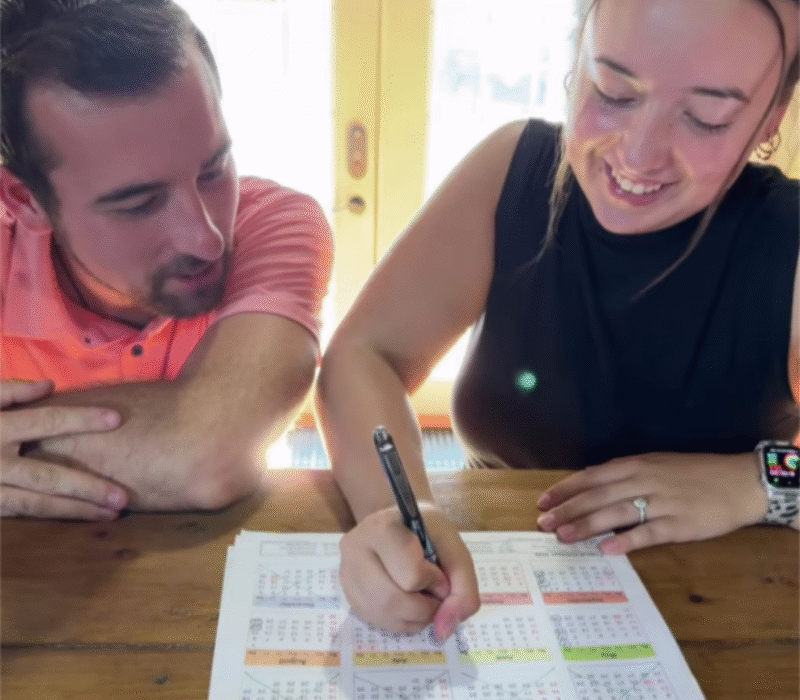

Photo credit: www.IrishHillsWeddings.com

2. Why It’s Worth Every Penny

Here’s what wedding/event/liquor insurance can do for you:

- Protects Your Investment

With weddings often costing tens of thousands, insurance (typically $100–$500) can save you thousands if anything goes wrong. - Peace of Mind

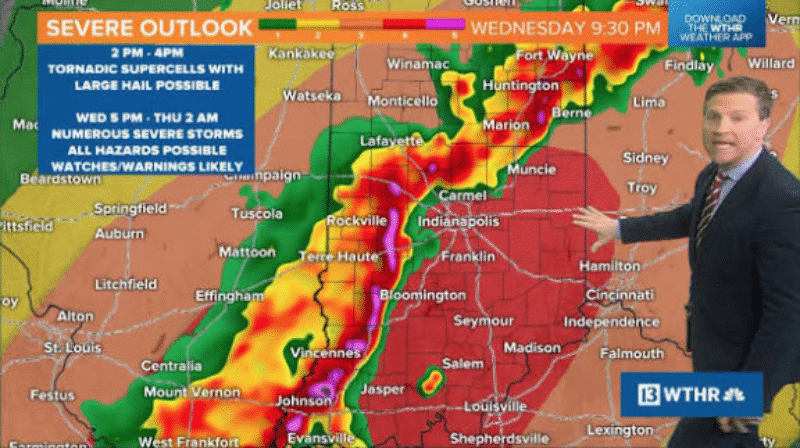

Don’t lose sleep over what-ifs. Know that if your DJ cancels, or weather ruins your outdoor ceremony, you’re covered. - Covers Vendor and Weather Issues

If a vendor flakes or a freak thunderstorm forces you indoors, cancellation insurance can help you rebook and recover your deposits. - Liability & Guest Safety

If a guest trips on a dance floor or breaks a window with an accidental elbow, you’re covered—so your celebration doesn’t turn into a lawsuit. - Alcohol Protection

If you’re hosting a bar, liquor liability insurance protects you and the venue from potential claims due to intoxicated guests.

3. Trusted Online Providers to Check Out

Here are several reputable companies that offer event, cancellation, and liquor liability insurance:

EventEnsure.com – Quick quotes for both general and liquor liability.

WedSafe – Offers both cancellation and liability (including liquor) coverage, often accepted by venues.

Eventsured.com – Fast, affordable coverage; liquor liability available as an add-on.

eWedInsurance.com – Offers separate or bundled packages for liability and cancellation with optional alcohol coverage.

The Event Helper (via Progressive) – Offers liquor liability bundled with general liability at competitive prices.

GEICO Wedding/Event Insurance – Offers flexible liability and cancellation coverage options with alcohol inclusion.

4. Smart Tips Before You Buy

- Buy Early: Get your policy as soon as you make deposits. Some policies won’t cover issues that arise before you buy.

- Know Your Venue’s Requirements: Many venues require at least $1M in liability and specific wording in the Certificate of Insurance (COI).

- Add Liquor Liability If Alcohol Is Involved: Especially important for open bars, family or farm/barn weddings.

- Bundle to Save: Many providers offer discounts for combining liability + cancellation + liquor coverage.

- Ask Your Vendors: Some caterers or bartending companies already carry their own insurance—just confirm if it extends to you as the host.

5. Real-Life Scenarios Where Insurance Saves the Day

- You have to cancel or postpone your wedding date!

- You or an immediate family member become seriously ill or forced to cancel.

- DJ Doesn’t Show? You’re reimbursed and can hire a replacement.

- Weather Ruins Your Outdoor Setup? Rescheduling costs are covered.

- Guest Trips and Breaks an Arm? Liability insurance handles the bills.

- Guest Leaves Tipsy, Causes a Car Accident? Liquor liability shields you from personal lawsuits.

Photo credit: Zolton - The Pilgrims West

6. Your Next Steps

1. Choose a provider like EventEnsure.com or another from the list above.

2. Get a quote based on your guest count, alcohol use, and event type.

3. Purchase early—before any red flags appear.

4. Send the Certificate of Insurance (COI) to your venue and vendors.

5. Relax & Celebrate knowing you’re protected!

Photo credit: Lucky Owl Photography

In Conclusion

Your wedding day should be about love, celebration, and unforgettable moments—not about worrying whether a vendor will show up or what happens if a tipsy guest causes trouble. For a relatively small cost, wedding event insurance and liquor liability insurance provide protection, peace of mind, and a safety net you hope you’ll never need—but will be thankful for if you do.

Here’s to a joy-filled, well-protected “I Do!” 💍

Joel Gresham (Aka The Wedding Guy)